We remind you that you have the opportunity to modify the contribution base of the Special Regime for Self-Employed Workers (RETA) and the corresponding fee, adjusting it to your actual income within the permissible limits according to age, until August 31, 2024. This modification will take effect from September 1, 2024. If you don't do so, you will continue to contribute based on the same rate you currently have.

Self-employed individuals are the only ones who can choose the contribution base they pay on. This decision is very important because it determines current benefits and future pension. The contribution base can be easily and telematically modified through the RED system. However, it is important to consider the procedures and the periods for making the change.

It's important to note that the contribution base is linked to the actual income you should have during the year 2024.

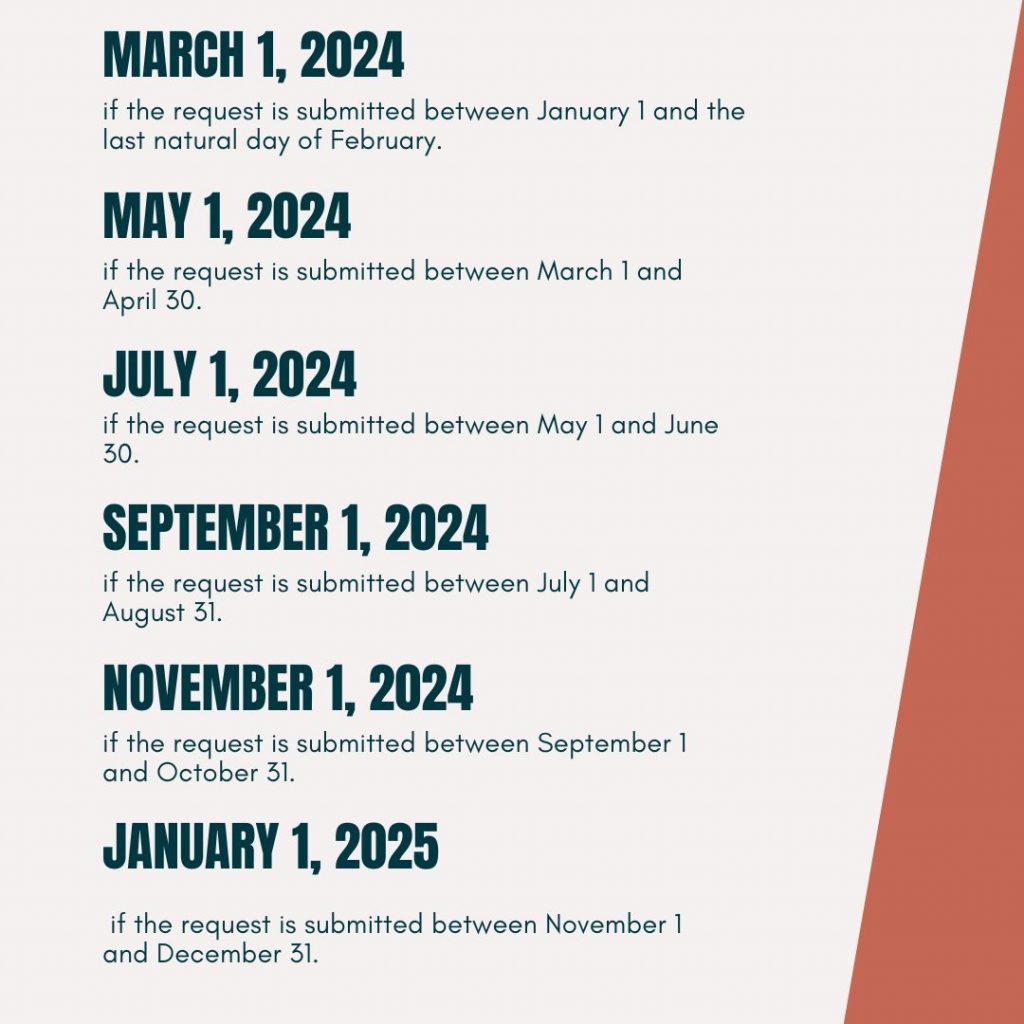

If there is an expected variation in net income throughout the year, every two months you can choose a new contribution base and therefore a new fee adjusted to the income, with a maximum of six changes per year.

This modification will take effect on the following dates:

Therefore, now, until August 31st, you can make a change in the bracket if you deem it appropriate. This will be the last day to request the change in contribution bases for the summer period. In this way, if you believe that your income will vary during the summer, you will be able to readjust your Social Security contributions.

How do I calculate my earnings?

The resulting amount will be deducted by 7% for general expenses, except in cases where the self-employed worker meets the following criteria, where the percentage will be 3%:

Administrator of capitalist mercantile companies whose participation is equal to or greater than 25%.

Partner in a capitalist mercantile company with a stake equal to or greater than 33%.

For the application of the specified percentage of 3%, it is sufficient to have been registered for ninety days under this special regime during the regularization period, under any of the aforementioned conditions.

Based on the monthly average of these annual net earnings, the contribution base will be selected to determine the fee payable.

Annually, the General State Budget Law will establish a table of general and reduced contribution bases divided into consecutive ranges of monthly net income amounts, to which maximum and minimum monthly contribution bases will be assigned for each range.

What happens if I choose a contribution base that ultimately does not correspond to my final earnings?

The monthly bases chosen each year will be provisional until the annual regularization of contributions takes place.

At the end of the calendar year, the Tax Administration will provide the Treasury with information on the actual annual income received. If the chosen contribution amount during the year turns out to be lower than that associated with the income reported by the corresponding Tax Administration, the worker will be notified of the amount of the difference. This amount must be paid by the last day of the month following the receipt of the notification with the regularization result.

If, on the contrary, the contribution were higher than that corresponding to the maximum base of the bracket in which the earnings are included, the Treasury will proceed to refund the difference before April 30 of the following year in which the corresponding Tax Administration has communicated the taxable income.

If you are interested in modifying your contribution base, please contact us!